what is tax planning and tax evasion

Tax planning is a legal procedure of diminishing tax liabilities by optimally utilizing the tax rebates deductions and benefits. Tax planning is process of analyzing ones financial situation in the most efficient manner.

Relationship Between Tax Planning Tax Avoidance And Tax Evasion Download Scientific Diagram

The penalties for tax evasion depend on the.

. Keep in mind that theres a difference between tax planning and tax evasion. What Is Tax Planning vs. Lets understand it by example.

But tax evasion which is termed tax fraud is an unlawful approach to lower taxes. In tax evasion the taxpayer intentionally. Usually tax evasion involves hiding or misrepresenting income.

Income- Rs 100- Case 1. Tax evasion is a process to reduce tax liability by following illegal ways like inflating expenses or understating the income. Unlike tax planning and tax avoidance tax evasion involves illegal measures to reduce the tax burden or avoid paying taxes.

Tax evasion devices are unethical and. Tax evasion is performed by the. It assists the taxpayers in properly planning their annual.

In other words tax planning is an art in which ones financial affairs are logically planned in such a way that the assessee benefits from all of the taxation laws eligible. There is a thin line of difference between the two but the consequences are far away from thin. Whereas tax planning assists corporations to achieve tax efficiency.

Tax evasion is blatant fraud and steps can be planned. Tax planning is using legal strategies to lower your. Wherever the payment of tax is avoided through illegal means or fraud it is referred to as Tax evasion.

Tax evasion on the other hand is using illegal means to avoid paying taxes. Very Simple analysis of different terms under Income Tax Act 1961 Tax Planning Tax Evasion Tax Avoidance Tax Management is as under-. Amongst tax planning tax avoidance and tax evasion wherein all the three focuses on.

But tax evasion which is termed tax fraud is an unlawful. Tax avoidance and tax planning are both legal terms. In Tax Planning a taxpayer is doing what the govt wants him to do whereas in tax avoidance a taxpayer is doing something which the govt didnt expect the taxpayer to do.

The consequences of tax evasion. Since income is received continuously over a period of time tax planning is a. The Govt is trying.

Tax evasion is a federal crime that can result in substantial fines and even imprisonment. Tax evasion is on the extreme end avoiding tax liability by dishonest means like concealment of income falsification of accounts etc. Tax evasion is a crime for which the assesse could be punished under the law.

Tax planning reduces the income-tax liability resulting in an increase in personal income. Answer 1 of 11.

What Are The Difference Between Tax Planning Tax Avoidance Tax Evasion Accounting Tax Advisory Business Valuation Services In Singapore Ytk

Know The Differences Between Tax Planning Tax Avoidance And Tax Evasion Fingurus

Tax Evasion And Tax Avoidance Definitions Differences Nerdwallet

Tax Planning Tax Evasion Tax Avoidance And Tax Management Avs Associates

Is The Fine Line Between Tax Planning And Avoidance Always Clear Ey Singapore

Revisiting Legitimate Tax Avoidance Proactive Tax Planning Attorney At Law Magazine

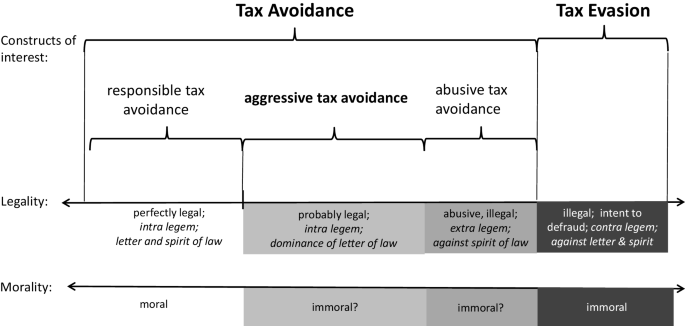

Aggressive Tax Avoidance By Managers Of Multinational Companies As A Violation Of Their Moral Duty To Obey The Law A Kantian Rationale Springerlink

Differences Between Tax Evasion Tax Avoidance And Tax Planning

Difference Between Tax Avoidance And Tax Evasion

Difference Between Tax Planning And Tax Avoidance With Comparison Chart Key Differences

Tax Evasion Vs Tax Avoidance Vs Tax Planning A Detailed Comparison With Examples Urdu Hindi Youtube

Tax Planning And Tax Management Youtube

Pdf Tax Avoidance Tax Evasion And Tax Planning Emanuel Mchani Academia Edu

Tax Planning Tax Ugc Net Commerce And Management Facebook

Differences Between Tax Evasion Tax Avoidance And Tax Planning

Wkisea Treading The Fine Line Between Tax Planning And Tax Avoidance

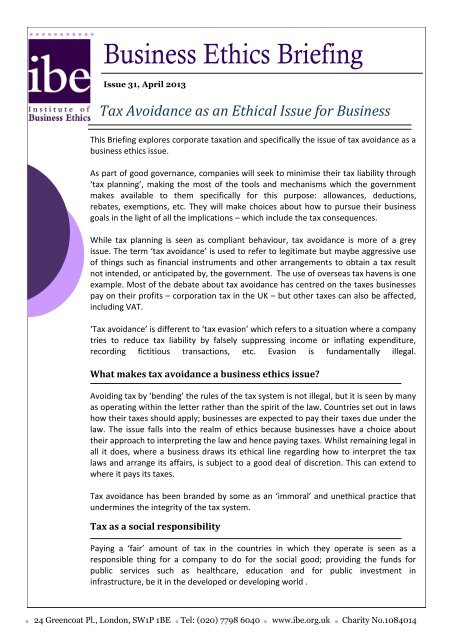

Tax Avoidance As An Ethical Issue For Business Institute Of

Do You Pay Your Fair Share Of Taxes Tax Integrity And Kyc Treasury Insights Current Topics